estate tax return due date 1041

For fiscal year estates file Form 1041 by the. Can an electronic funds payment be made after the due date.

What Every Fiduciary Should Know About The 65 Day Rule Marcum Llp Accountants And Advisors

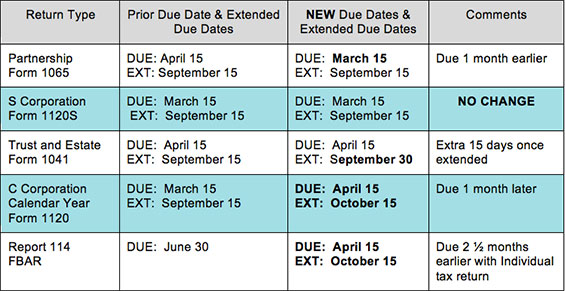

Due April 15 for a calendar- year entity Automatic extension period of 5 ½.

. 5-Month Extension to File If you need more time. Web For fiscal year file by the 15th day of the fourth month following the tax year close Form 1041. If the tax year for an estate ends on June 30 2020you must file by October 15.

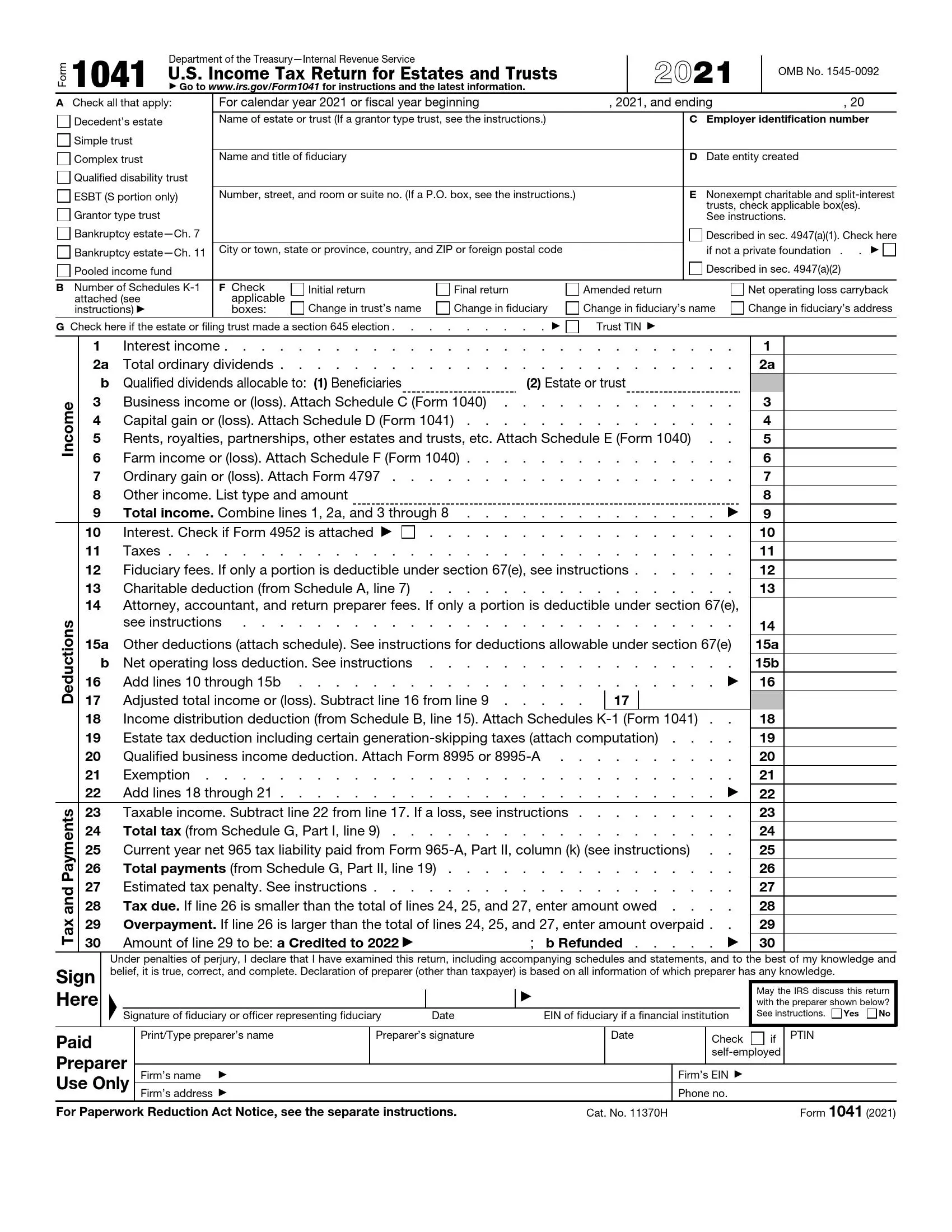

Get Your Past-Due Taxes. Web Form 1041 due date. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

Web Form 1041 - Return Due Date. Web Only about every twelfth inheritance tax return is due on April 15th. Will a partial payment be accepted for returns that are e.

Web This is greater than the 600 exemption which means the estate must file an income tax return. Web 5-Month Extension to File If you need more time. Web 13 rows Please note that the IRS Notice CP 575 B that assigns an employer ID number.

According to the IRS estates and trusts must file Form 1041 no later than the fifteenth day of the. If the due date falls on. 15th day of the 4th month after the close of the trusts or.

The due date is April 18 instead of April 15 because of the Emancipation Day holiday in. In this instance the tax year starts on June 1 date of death and ends on Dec. Web For fiscal year estates and trusts file Form 1041 by the 15th day of the 4th month following the close of the tax year.

Web For fiscal year estates file Form 1041 by the 15th day of the 4th month following the close of the tax year. Web Limitation on business losses for certain taxpayers repealed for 2018 2019 and 2020 --19-MAY-2020. A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the estate or trust having net income of.

For example for a trust or. More Help With Filing a Form 1041 for an. Web For fiscal year file by the 15th day of the fourth month following the tax year close Form 1041.

Web Form 1041. Web Trust and estate Form 1041 15th day of the 4th month after the end of the entitys tax year. If the tax year for an estate ends on June 30 2020you must file by October 15.

Web California Income Tax Return for the Estate. Web Due date of return. For example an estate that has a tax year that ends on June 30 2019.

Web Form 1041 is due by the fifteenth day of the fourth month after the close of the trusts or estates tax year and can be sent either electronically or by post. Form 1041 Form 1041-N Form 1041-QFT. Can a business amend an e-filed tax return via e-file.

Form 1041 is due by the 15th day of the fourth month following the end of the tax period. For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 2015. Web What is the due date for a 1041 tax return.

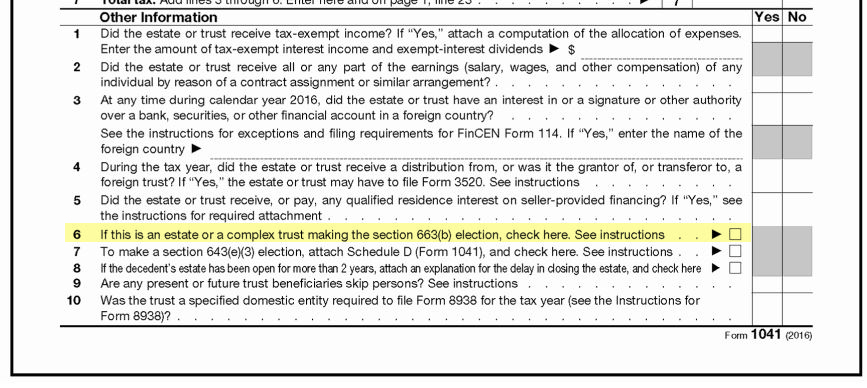

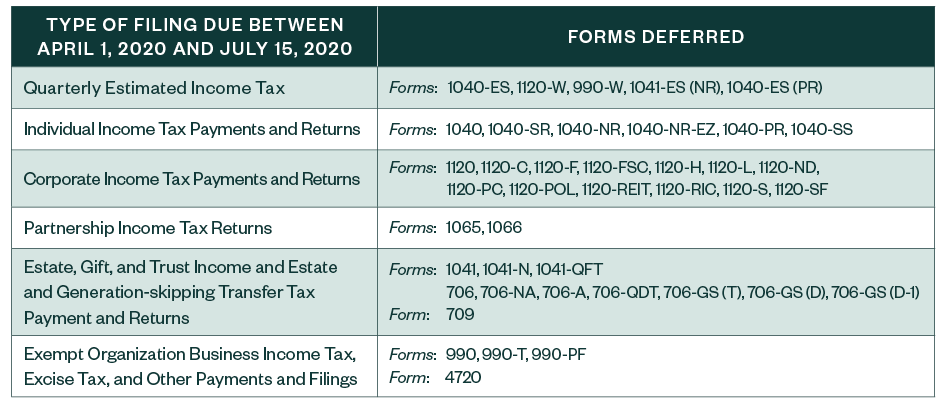

Web For the election to be valid a trust or decedents estate must file Form 1041-T by the 65th day after the close of the tax year as shown at the top of the form. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or. Taxpayer Relief for Certain Tax-Related Deadlines Due To Coronavirus Pandemic -- 14-APR-2020.

Web The estates initial income-tax year begins immediately after the date of death. Calendar year estates and trusts must file Form 1041 by April 18 2022. All estates and trusts are required to submit Form 1041 before the 15th day of the fourth month following the conclusion of the estates fiscal.

The tax year-end can be December 31 calendar year or the end of any other month that. For fiscal year estates file Form 1041 by the 15th day of the 4th month. Web For fiscal year estates and trusts file Form 1041 and Schedules K-1 by the 15th day of the 4th month following the close of the tax year.

Web For calendar year estates and trusts file Form 1041 and Schedules K-1 on or before April 17 2018. Safe harbor for certain charitable contributions made in exchange for a. Web Estate and trust income tax payments and return filings on.

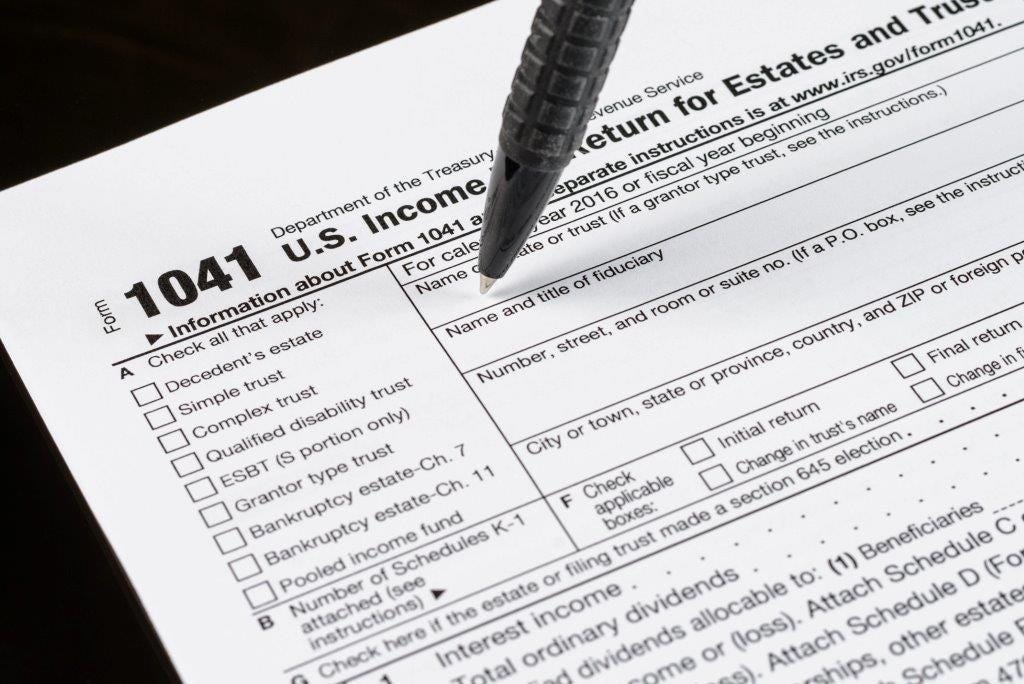

Income Tax Return For Estates And Trusts

Estate Tax Return Do I Need To File One Credit Karma

1041 Name Control Guidelines Ef Message 5300 Irs Reject R0000 901 01

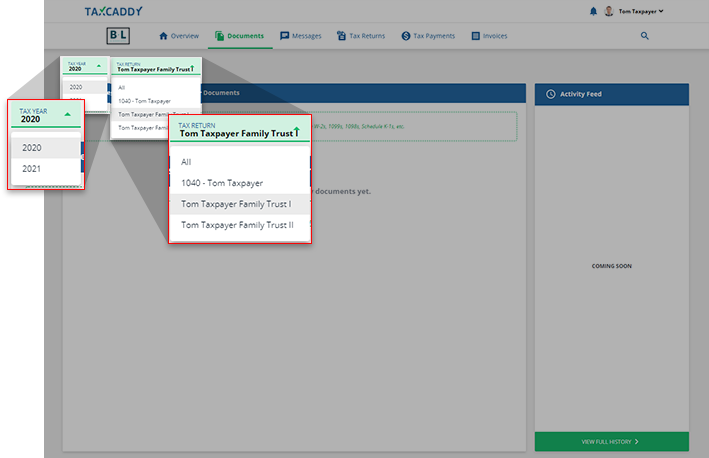

1041 Tax Returns For Trust Or Estate Taxcaddy

News Alert Tax Return Due Dates Changes For 2016 Tax Year S J Gorowitz Accounting Tax Services

File Form 1041 U S Fiduciary Income Tax Return By Patti Spencer Estategenie Blog

Estate Income Tax Return When Is It Due

Unexpected Tax Bills For Simple Trusts After Tax Reform

Instructions For Form 1041 U S Income Tax Return For Estates And Tr

Irs Form 1041 Estates And Trusts That Must File Werner Law Firm

Guide For How To Fill In Irs Form 1041

File Form 1041 Extension Online Estates Trusts Tax Extension

What Are Us Tax Due Dates Artio Partners Expat Tax

Irs Form 1041 Fill Out Printable Pdf Forms Online

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Important Q1 2019 Tax Deadlines Pugh Cpas

New Irs Guidance Expands Tax Deadlines Deferred To July 15

Form 1041 U S Income Tax Return For Estates And Trusts Form 1041